Diving into the realm of term life insurance rates, this introduction sets the stage for a detailed exploration of the key factors that influence these rates. From age and health considerations to coverage amount and term length, we will uncover the nuances that shape the cost of term life insurance policies.

As we delve deeper into the intricacies of term life insurance rates, readers will gain valuable insights into the dynamics of pricing in this essential financial product.

Understanding Term Life Insurance Rates

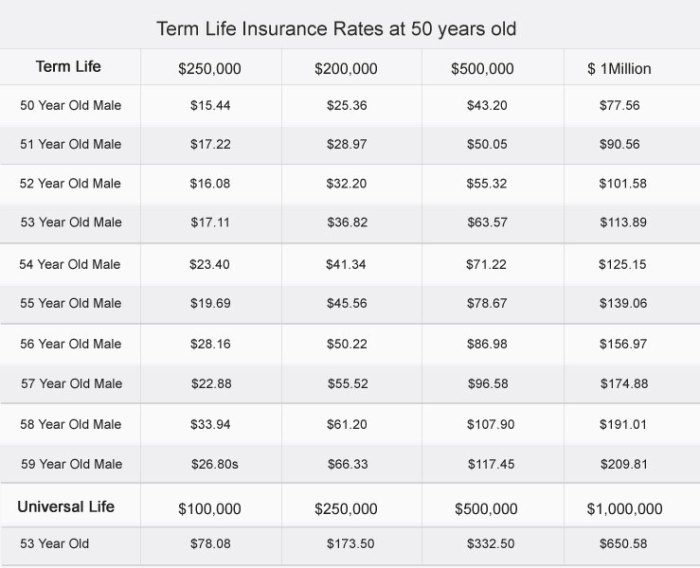

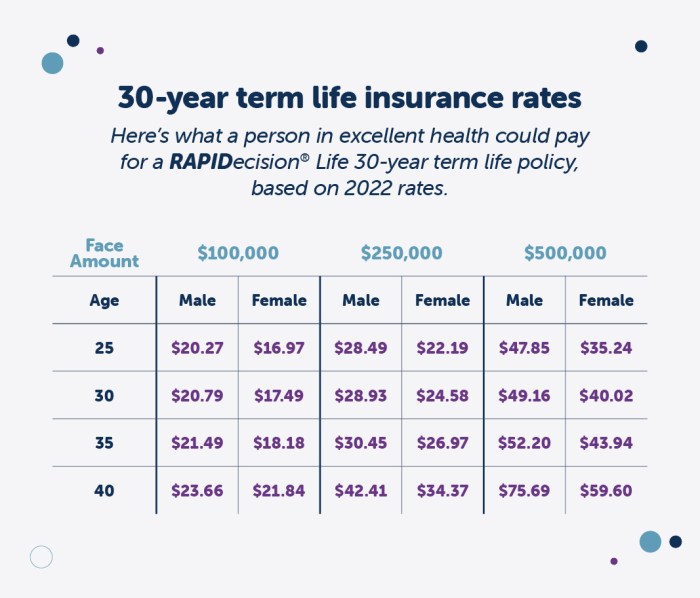

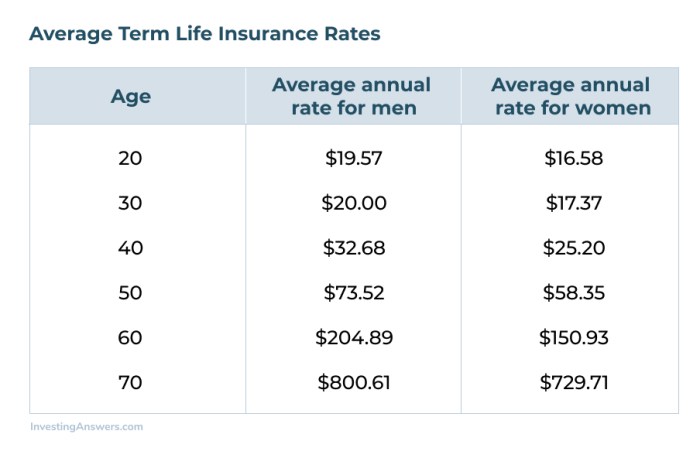

When it comes to term life insurance rates, several factors come into play that determine how much you will pay for coverage. Factors such as age, health, coverage amount, and term length all play a significant role in determining your premiums.

Age and Health Impact

Age and health are two major factors that influence term life insurance rates. Younger individuals generally pay lower premiums because they are considered lower risk. On the other hand, older individuals and those with pre-existing health conditions may face higher rates due to the increased likelihood of health issues.

Coverage Amount and Term Length

The coverage amount you choose and the length of the term also impact your term life insurance rates. Opting for a higher coverage amount will result in higher premiums since the insurance company will need to provide a larger payout in the event of your death.

Similarly, longer term lengths typically come with higher premiums compared to shorter terms, as the insurance company is taking on the risk of insuring you for a longer period of time.

Comparing Term Life Insurance Rates

When it comes to term life insurance rates, it's crucial to compare quotes from different insurance providers to ensure you're getting the best coverage at the most affordable price. Rates can vary significantly based on a variety of factors, so it's important to understand how they are determined and what options are available to you.

Variation in Coverage Options

- Term lengths: The length of the term you choose can impact your insurance rates. Typically, longer terms come with higher premiums.

- Coverage amount: The amount of coverage you select will also affect your rates. Higher coverage amounts will result in higher premiums.

- Additional riders: Adding extra features or riders to your policy, such as accidental death or critical illness coverage, can increase your premiums.

Smokers vs. Non-Smokers

- Smokers tend to pay significantly higher rates compared to non-smokers due to the health risks associated with smoking.

- Insurance providers categorize individuals as smokers based on their tobacco use within the past 12 months, so it's essential to be honest about your smoking habits when applying for coverage.

- Non-smokers can enjoy lower rates and better overall health outcomes, making it a more cost-effective option in the long run.

Tips for Getting Affordable Term Life Insurance Rates

When it comes to term life insurance, finding affordable rates can make a significant difference in your financial planning. Here are some tips to help you secure the best rates for your term life insurance policy.

Strategies for Reducing Term Life Insurance Rates

- Consider buying a policy when you are younger and healthier, as rates are typically lower for individuals in good health.

- Opt for a shorter term length, as longer terms generally come with higher premiums.

- Choose a policy with a lower coverage amount that meets your needs, as higher coverage amounts can lead to higher premiums.

- Quit smoking, as tobacco users often face higher rates due to health risks associated with smoking.

Improving Your Health for Lower Term Life Insurance Rates

- Adopt a healthy lifestyle by maintaining a balanced diet and regular exercise routine to improve your overall health.

- Undergo regular health check-ups and screenings to address any health concerns promptly and show insurers that you are proactive about your well-being.

- Avoid risky behaviors and maintain a safe lifestyle to reduce the chances of accidents and health complications.

Importance of Comparing Quotes for Affordable Term Life Insurance Rates

- Request quotes from multiple insurance providers to compare rates, coverage options, and benefits to find the most cost-effective policy.

- Consider working with an independent insurance agent who can help you navigate different options and find the best rates based on your needs and budget.

- Review and understand the policy details, including any exclusions or limitations, to ensure that you are getting the coverage you need at a reasonable rate.

Understanding Term Life Insurance Rate Increases

When it comes to term life insurance, it's important to understand why rates may increase over time. Let's delve into the factors that can impact the cost of your coverage.

Impact of Renewing a Term Life Insurance Policy on Rates

Renewing a term life insurance policy can lead to an increase in rates due to several reasons. As you renew your policy, you are older, which poses a higher risk to the insurance company. Additionally, any health issues that have developed since you initially purchased the policy can also impact the new rate.

It's essential to be aware of these potential rate increases when considering renewing your term life insurance.

Situations that may Cause Term Life Insurance Rates to Go Up

There are various situations that could cause term life insurance rates to increase. For example, if you have a history of health issues, engage in high-risk activities, or if there have been changes in your lifestyle or occupation that pose a greater risk, your rates may go up.

Furthermore, economic factors and changes in the insurance market can also influence rate increases. It's crucial to stay informed and understand the factors that can impact your term life insurance rates.

Closing Summary

In conclusion, we have navigated through the complexities of term life insurance rates, shedding light on the various aspects that determine the cost of coverage. Whether it's understanding rate increases or comparing quotes for affordability, this guide equips you with the knowledge needed to make informed decisions about your insurance needs.

Query Resolution

What factors influence term life insurance rates?

Term life insurance rates are influenced by factors such as age, health condition, coverage amount, and term length.

How do coverage options impact term life insurance rates?

The type of coverage options chosen, such as riders or additional benefits, can affect the overall cost of term life insurance rates.

Why may term life insurance rates increase over time?

Term life insurance rates may increase over time due to factors like age, health changes, or the expiration of a term policy.

How can one improve health to get lower term life insurance rates?

Improving health through lifestyle changes like quitting smoking, regular exercise, and a balanced diet can help in securing lower term life insurance rates.

Why is it important to compare quotes for term life insurance rates?

Comparing quotes from different insurance providers allows individuals to find the most affordable term life insurance rates that suit their needs and budget.