Diving into the realm of term life insurance quotes, this introduction sets the stage for an intriguing discussion that sheds light on the ins and outs of this financial tool.

Providing insights into the significance of term life insurance quotes, this paragraph aims to educate and inform readers about the importance of securing the right coverage for their future financial well-being.

Introduction to Term Life Insurance Quote

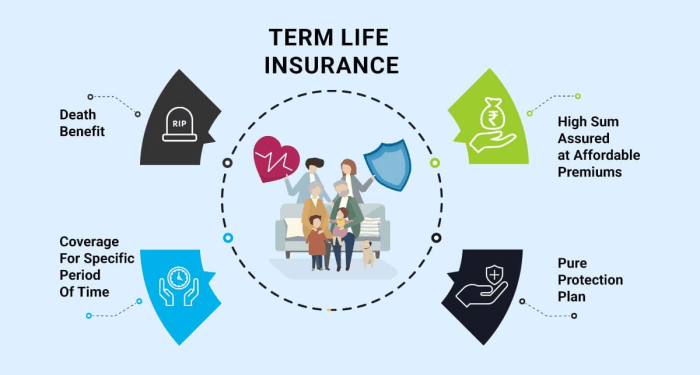

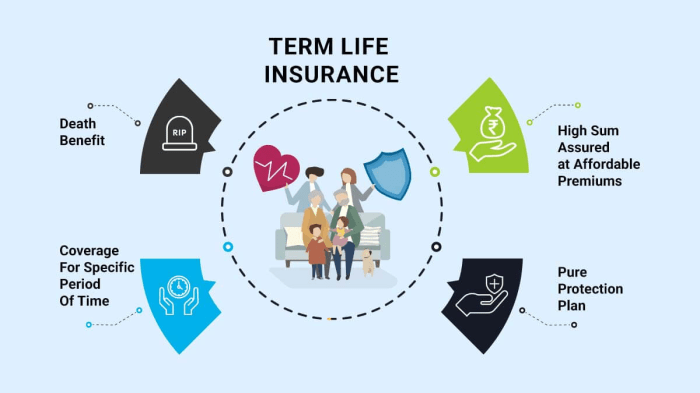

Term life insurance quote is an estimate of the premium cost for a specific term life insurance policy. Unlike other types of insurance, term life insurance provides coverage for a set period, typically ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term of the policy.

Importance of Getting a Term Life Insurance Quote for Financial Planning

Obtaining a term life insurance quote is crucial for financial planning as it helps individuals understand the cost associated with securing protection for their loved ones. By knowing the estimated premium amount, individuals can budget accordingly and ensure that their beneficiaries are financially supported in the event of their untimely death.

Why Individuals Should Consider Getting a Term Life Insurance Quote

- Provides Financial Security: A term life insurance quote allows individuals to assess the affordability of coverage and determine the amount of protection needed to secure their family's financial future.

- Ease of Comparison: By obtaining multiple term life insurance quotes, individuals can compare premiums, coverage options, and benefits offered by different insurance providers to make an informed decision.

- Peace of Mind: Knowing that loved ones will be financially protected in case of an unexpected tragedy can offer peace of mind and relieve stress related to financial uncertainties.

Factors Influencing Term Life Insurance Quotes

When it comes to determining the cost of a term life insurance quote, several key factors come into play. These factors include age, health, coverage amount, and the length of the term. Insurers carefully consider these elements to calculate the premium for a term life insurance policy.

Age

Age is a significant factor in determining the cost of a term life insurance quote. Younger individuals typically pay lower premiums compared to older individuals. This is because younger people are generally considered lower risk and are less likely to pass away during the policy term.

Health

The health of the individual applying for a term life insurance policy also plays a crucial role in determining the premium. Those with pre-existing health conditions or unhealthy lifestyle habits may face higher premiums due to the increased risk of mortality during the policy term.

Coverage Amount

The coverage amount, or the death benefit, selected by the policyholder directly impacts the cost of the term life insurance quote. Higher coverage amounts result in higher premiums, as the insurer will have to pay out a larger sum in the event of the policyholder's death.

Term Length

The length of the term chosen for a term life insurance policy also influences the premium. Shorter terms typically have lower premiums as the risk of the policyholder passing away within that period is lower. In contrast, longer terms may have higher premiums due to the extended coverage period.

How to Obtain a Term Life Insurance Quote

Obtaining a term life insurance quote is a crucial step in securing financial protection for your loved ones. Here's how you can go about getting a quote:

Steps Involved in Obtaining a Term Life Insurance Quote

- Research Insurance Providers: Start by researching reputable insurance companies that offer term life insurance policies.

- Visit Insurer Websites: Visit the websites of these insurers to obtain online quotes or contact them directly for personalized quotes.

- Provide Necessary Information: When requesting a term life insurance quote, you will need to provide information such as your age, gender, health history, lifestyle habits, and the coverage amount you are seeking.

- Review and Compare Quotes: Once you receive quotes from different insurers, take the time to review and compare them. Consider factors such as premium costs, coverage limits, and any additional benefits offered.

- Select the Best Option: After comparing quotes, choose the term life insurance policy that best fits your needs and budget.

Importance of Comparing Quotes from Different Insurers

Comparing term life insurance quotes from various insurers is essential for several reasons:

- Cost Savings: By comparing quotes, you can identify the most cost-effective option that provides adequate coverage.

- Customized Coverage: Each insurer may offer different policy features and benefits, allowing you to tailor your coverage to meet your specific needs.

- Financial Security: Choosing a reputable insurer with competitive rates ensures that your beneficiaries will receive the financial support they need in the event of your passing.

- Peace of Mind: By comparing quotes, you can make an informed decision and have peace of mind knowing that your loved ones will be financially protected.

Understanding Term Life Insurance Quote Terms

In order to fully grasp a term life insurance quote, it is essential to understand the key terms that are commonly used throughout the process. These terms play a crucial role in determining the specifics of your policy and the overall quoting process.

1. Premium

The premium is the amount of money you pay to the insurance company in exchange for coverage. It is typically paid on a monthly or annual basis, and the cost can vary based on factors such as age, health, and coverage amount.

2. Coverage Amount

The coverage amount refers to the sum of money that will be paid out to your beneficiaries upon your death. This amount is chosen by you when setting up the policy and should be enough to provide financial security to your loved ones.

3. Term Length

The term length is the duration for which the policy will remain in effect. Common term lengths include 10, 20, or 30 years. Once the term ends, you may have the option to renew the policy or convert it to a permanent life insurance policy.

4. Beneficiary

A beneficiary is the person or entity who will receive the death benefit when the policyholder passes away. It is crucial to designate a beneficiary and keep this information up to date to ensure that your loved ones are taken care of.These terms work together to form the foundation of your term life insurance policy and directly impact the cost and coverage provided.

By understanding these terms, you can make informed decisions when obtaining a term life insurance quote.

Benefits of Comparing Term Life Insurance Quotes

When it comes to securing the best term life insurance coverage at an affordable rate, comparing multiple quotes can be highly beneficial. By taking the time to evaluate different options, individuals can make informed decisions that suit their needs and budget.

Advantages of Comparing Multiple Term Life Insurance Quotes

- Allows for a comprehensive assessment of available coverage options.

- Helps in understanding the range of premiums offered by different insurance providers.

- Enables individuals to customize their coverage based on their specific requirements.

- Empowers consumers to make cost-effective choices without compromising on quality.

How Comparing Quotes Can Help Find the Best Coverage at an Affordable Rate

- Identify the most competitive premiums in the market.

- Evaluate the coverage benefits offered by each policy.

- Consider additional features or riders that may be included in the policy.

- Ensure transparency in pricing and terms to avoid hidden costs or surprises later on.

Tips on Effectively Comparing Term Life Insurance Quotes

- Request quotes from multiple reputable insurance companies to broaden your options.

- Compare policies with similar coverage amounts and terms for an accurate comparison.

- Consider the financial stability and reputation of the insurance provider before making a decision.

- Review customer reviews and ratings to gauge the quality of service provided by the insurer.

Epilogue

In conclusion, the journey through term life insurance quotes reveals a landscape of options and considerations that can impact one's financial planning. This summary encapsulates the key points discussed and leaves readers with a deeper understanding of this vital aspect of insurance.

Essential Questionnaire

What factors can influence the cost of a term life insurance quote?

Factors such as age, health condition, coverage amount, and term length can all play a role in determining the premium for a term life insurance quote.

How can individuals obtain a term life insurance quote?

Individuals can obtain a term life insurance quote by reaching out to insurance providers, providing necessary information such as personal details, health history, and coverage preferences.

What are some common terms used in term life insurance quotes?

Common terms include premium (cost of the policy), coverage amount (the sum assured), term length (duration of coverage), and beneficiary (recipient of the policy benefits).