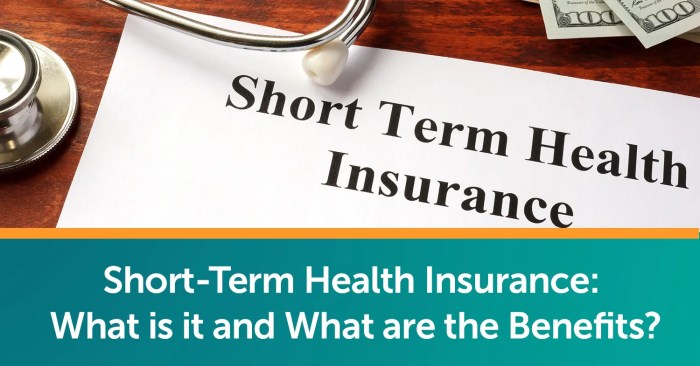

Exploring the realm of short term health insurance quotes unveils a landscape filled with various options and considerations. This guide aims to provide a detailed overview, shedding light on the intricacies of obtaining and understanding these quotes.

Dive into the nuances of short term health insurance quotes and empower yourself with the knowledge needed to make informed decisions regarding your healthcare coverage.

Types of Short Term Health Insurance

Short term health insurance plans are designed to provide temporary coverage for individuals in need of immediate medical insurance. These plans offer flexibility and affordability, making them an attractive option for those in transition or facing gaps in coverage.

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, allow policyholders to choose their healthcare providers and pay for services upfront. The insurance company then reimburses a portion of the costs based on a fixed fee schedule. This type of plan offers flexibility but may require more out-of-pocket expenses.

Managed Care Plans

Managed care plans include Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans. HMO plans require policyholders to choose a primary care physician and obtain referrals for specialists, while PPO plans offer more flexibility in provider choices. These plans often have lower out-of-pocket costs but restrict coverage to in-network providers.

Short Term Medical Plans

Short term medical plans provide temporary coverage for unexpected illnesses or injuries. These plans typically offer basic medical benefits and can be purchased for a limited duration, ranging from a few months to a year. While they are more affordable than traditional health insurance, they may not cover pre-existing conditions or preventive care.

Critical Illness Insurance

Critical illness insurance provides a lump sum payment upon diagnosis of a serious medical condition, such as cancer, heart attack, or stroke. This type of plan can help cover expenses not included in traditional health insurance, such as lost income or experimental treatments.

It is important to note that critical illness insurance does not provide comprehensive medical coverage.

Accident Insurance

Accident insurance offers financial protection in the event of injuries resulting from accidents, such as broken bones, burns, or concussions. This type of plan covers medical expenses, lost income, and other costs associated with accidental injuries. Accident insurance is a supplemental policy that can complement short term health insurance coverage.

Factors Affecting Short Term Health Insurance Quotes

When it comes to short term health insurance, several factors can influence the cost of insurance quotes. These factors play a crucial role in determining how much you will pay for coverage. Let's explore the key factors that impact short term health insurance quotes:

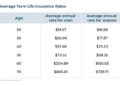

Age

Age is a significant factor that affects short term health insurance quotes. Generally, younger individuals tend to pay lower premiums compared to older individuals. This is because younger people are typically healthier and have fewer pre-existing conditions, making them less risky for insurance companies.

Health Status

Your current health status also plays a vital role in determining the cost of short term health insurance. Individuals with pre-existing conditions or chronic illnesses may face higher premiums as they are considered higher risk by insurance providers. Your overall health condition can significantly impact the price you pay for coverage.

Coverage Limits

The coverage limits you choose for your short term health insurance policy can affect the quotes you receive. Opting for higher coverage limits will naturally result in higher premiums. It's essential to strike a balance between the coverage you need and the cost you can afford when selecting your coverage limits.

Deductibles

The deductible amount you choose can also impact the cost of short term health insurance quotes. A higher deductible typically means lower monthly premiums, but you will have to pay more out of pocket before your insurance coverage kicks in.

On the other hand, a lower deductible will result in higher premiums but lower out-of-pocket costs when you need medical care.

Geographical Location

Geographical location can also influence the pricing of short term health insurance. Healthcare costs vary significantly from one region to another, and insurance premiums are often adjusted to reflect these differences

Obtaining Short Term Health Insurance Quotes

When it comes to obtaining short term health insurance quotes, there are several steps to follow to ensure you get the best coverage for your needs at the most affordable price. It's essential to request and compare quotes from different insurance providers to make an informed decision.

Requesting Short Term Health Insurance Quotes

- Start by researching reputable insurance companies that offer short term health insurance plans.

- Visit the websites of these companies or contact them directly to request a quote. Provide accurate information about your health history, age, and coverage needs.

- Compare the quotes you receive, paying attention to the coverage details, premiums, deductibles, and any exclusions or limitations.

Reviewing Coverage Details and Exclusions

- Carefully review the coverage details in each insurance quote to ensure it meets your specific health needs, including doctor visits, prescription medications, and emergency care.

- Pay attention to any exclusions or limitations in the policy, such as pre-existing conditions or specific treatments that may not be covered.

- Consider the network of healthcare providers included in the insurance plan to ensure you can access quality care when needed.

Negotiating or Customizing the Policy

- If you find a short term health insurance policy that meets most of your needs but has some limitations, consider negotiating with the insurance provider to customize the policy.

- You may be able to adjust the coverage options, deductibles, or premiums to better suit your budget and health requirements.

- Work with an insurance agent or representative to explore different options and find a policy that offers the right balance of coverage and affordability for you.

Understanding Short Term Health Insurance Quote Details

When reviewing a short term health insurance quote, it's essential to understand the various components that make up the total cost and coverage. Let's break down a sample short term health insurance quote to explain each component and how they work.

Premiums

The premium is the amount you pay for the insurance policy, typically on a monthly basis. It is important to note that short term health insurance premiums are generally lower than traditional health insurance plans due to the limited coverage period.

Copayments

Copayments are fixed amounts that you pay out of pocket for covered services, such as doctor visits or prescription medications. These are due at the time of service and are separate from your premium.

Coinsurance

Coinsurance is the percentage of costs you are responsible for after meeting your deductible. For example, if your coinsurance is 20%, you would pay 20% of covered expenses while the insurance company covers the remaining 80%.

Out-of-Pocket Maximums

The out-of-pocket maximum is the most you will have to pay for covered services in a policy period. Once you reach this limit, the insurance company will cover 100% of covered expenses for the remainder of the policy period.Common terminology used in short term health insurance quotes includes deductible, which is the amount you must pay before the insurance company starts covering costs, and exclusions, which are services or treatments not covered by the policy.

Understanding these terms and how they impact your coverage and costs is crucial when evaluating short term health insurance quotes.

Final Conclusion

In conclusion, navigating the realm of short term health insurance quotes can be complex, but with the right information at your disposal, you can confidently select a plan that aligns with your needs. Stay informed, stay covered, and prioritize your health above all else.

General Inquiries

What factors influence the cost of short term health insurance quotes?

The cost of short term health insurance quotes is influenced by factors such as age, health status, coverage limits, deductibles, and geographical location.

How can I customize a short term health insurance policy based on the quotes received?

You can customize a short term health insurance policy by negotiating with the insurance provider, reviewing coverage details and exclusions, and selecting options that best suit your needs.

What are some common terminologies used in short term health insurance quotes?

Common terminologies in short term health insurance quotes include premiums, copayments, coinsurance, and out-of-pocket maximums, each playing a vital role in determining the overall coverage and cost.