Delving into life insurance companies, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Life insurance companies play a crucial role in the financial market, offering various products to provide financial security for individuals and families. In this guide, we will explore the significance of life insurance, the services offered by these companies, and the impact of technology on the industry.

Overview of Life Insurance Companies

Life insurance companies play a crucial role in the financial market by providing individuals with a means of protecting their loved ones financially in the event of their death. These companies offer various life insurance products that cater to different needs and preferences of policyholders.

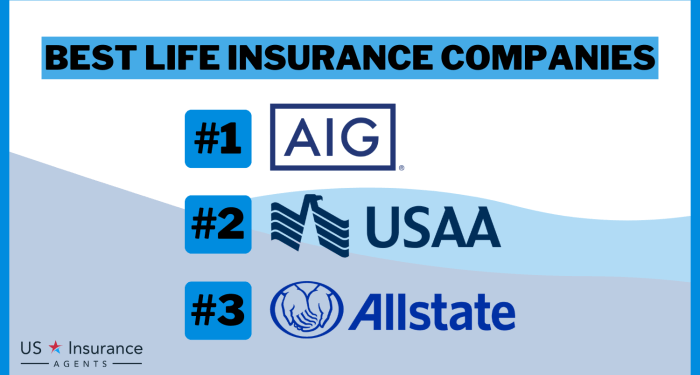

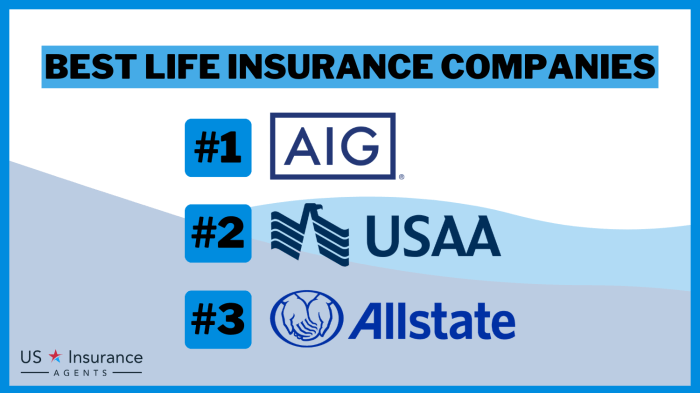

Examples of Well-Known Life Insurance Companies Globally

- Prudential Financial

- MetLife

- New York Life Insurance Company

- AXA

- Manulife Financial

Types of Life Insurance Products Offered

- Term Life Insurance: Provides coverage for a specific period and pays out a benefit if the insured passes away during the term.

- Whole Life Insurance: Offers coverage for the entire life of the insured and includes a cash value component that grows over time.

- Universal Life Insurance: Combines a death benefit with a savings component that earns interest.

- Variable Life Insurance: Allows policyholders to allocate their premiums to various investment options.

Importance of Life Insurance

Life insurance is crucial for providing financial security and peace of mind to your loved ones in the event of your unexpected death. It ensures that they are taken care of and can maintain their quality of life even after you are no longer there to provide for them.

Benefits of Term Life Insurance vs. Whole Life Insurance

Term life insurance offers coverage for a specific period, usually ranging from 10 to 30 years, and is more affordable compared to whole life insurance. On the other hand, whole life insurance provides coverage for your entire life and includes a cash value component that grows over time.

While term life insurance is suitable for covering temporary needs, such as paying off a mortgage or providing for children's education, whole life insurance offers lifelong protection and can also serve as an investment opportunity.

Assessment of Risk and Premium Determination

- Life insurance companies assess risk factors such as age, health condition, occupation, and lifestyle habits to determine the likelihood of the policyholder's death.

- Based on these risk factors, insurance companies calculate premiums that the policyholder needs to pay to maintain the coverage.

- Individuals with higher risk factors, such as older age or pre-existing health conditions, may have to pay higher premiums compared to those with lower risk factors.

- Insurance companies use actuarial tables and statistical data to analyze risk and set appropriate premium rates to ensure the financial stability of the company while providing adequate coverage to policyholders.

Customer Service and Support

Life insurance companies prioritize providing excellent customer service to their policyholders. They offer various support options to ensure a smooth and hassle-free experience for their customers.

Customer Service Options

- 24/7 Customer Support: Most life insurance companies offer round-the-clock customer service to address any queries or concerns that policyholders may have.

- Online Portals: Policyholders can access their policy details, make premium payments, and even file claims through secure online portals provided by the insurance companies.

- Dedicated Agents: Many companies assign dedicated agents to guide policyholders through the entire process, from purchasing a policy to making a claim.

Claims Processing and Payouts

Life insurance companies have a streamlined process for handling claims to ensure timely payouts to beneficiaries. When a claim is filed, the company verifies the documents and processes the payout efficiently.

Positive Customer Experiences

- A policyholder shared how their insurance agent went above and beyond to explain the policy details and help them choose the right coverage for their needs.

- Another customer praised the quick and hassle-free claim settlement process after the unfortunate loss of a loved one.

Technology and Innovation

Life insurance companies are constantly looking for ways to enhance their customer experiences through the use of technology. By leveraging data analytics and artificial intelligence (AI), these companies are able to improve risk assessment and underwriting processes, resulting in more personalized and efficient services for their clients.

Use of Data Analytics and AI

Life insurance companies are utilizing data analytics to analyze vast amounts of information and identify trends that may impact risk assessment. By incorporating AI algorithms into their processes, insurers can make more accurate predictions about potential claims and tailor their policies to better suit individual needs.

This not only helps in reducing risks for the company but also ensures that customers receive the most relevant coverage at competitive rates.

Innovative Digital Tools

In addition to data analytics and AI, life insurance companies are also offering innovative digital tools to enhance customer engagement and make the insurance buying process more convenient. For example, some companies have developed mobile apps that allow customers to easily access their policy information, make premium payments, or even file claims directly from their smartphones.

These tools not only streamline the customer experience but also provide valuable insights for insurers to further improve their services.

Closure

In conclusion, life insurance companies are vital players in the financial landscape, providing peace of mind and financial protection to policyholders. From customer service to technological innovations, these companies continue to evolve to meet the changing needs of their customers.

Key Questions Answered

What factors do life insurance companies consider when determining premiums?

Life insurance companies assess factors such as age, health, lifestyle, occupation, and coverage amount to determine premiums.

Can I switch from term life insurance to whole life insurance?

Yes, it is possible to switch from term life insurance to whole life insurance, but it is essential to consider the implications and benefits of each type.

How do life insurance companies handle claims processing?

Life insurance companies typically have a claims department that reviews submitted claims, verifies the information, and processes payouts to beneficiaries.