Diving into the realm of homeowners insurance quotes, this introduction sets the stage for a comprehensive examination of the intricacies involved. From understanding the significance of obtaining a quote to unraveling the various factors influencing it, this piece aims to equip readers with valuable insights in a casual formal language style.

Moving forward, we will delve deeper into the components, process, and essential tips related to homeowners insurance quotes.

Introduction to Homeowners Insurance Quote

A homeowners insurance quote is an estimate of the cost of insuring your home against risks such as damage, theft, or liability. It is provided by insurance companies based on various factors.

Importance of Getting a Homeowners Insurance Quote

It is important to get a homeowners insurance quote to understand the potential cost of protecting your home and belongings. Without insurance, you could face significant financial losses in the event of a disaster.

Factors Influencing Homeowners Insurance Quotes

- The location of your home, including proximity to fire stations, crime rates, and weather risks.

- The age and condition of your home, as well as the materials used in its construction.

- The coverage limits and deductible you choose, which can affect the overall cost of the policy.

- Your claims history and credit score, as these can impact the risk you pose to the insurance company.

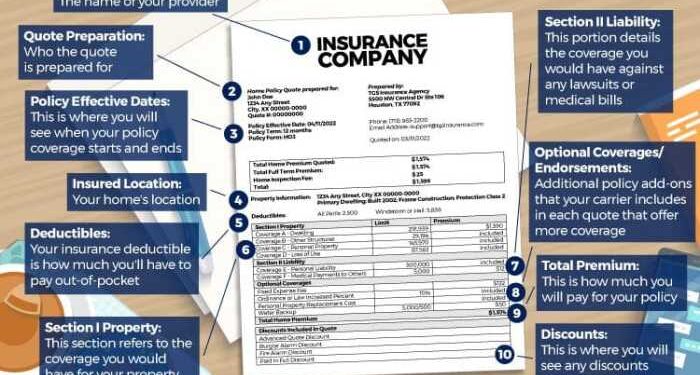

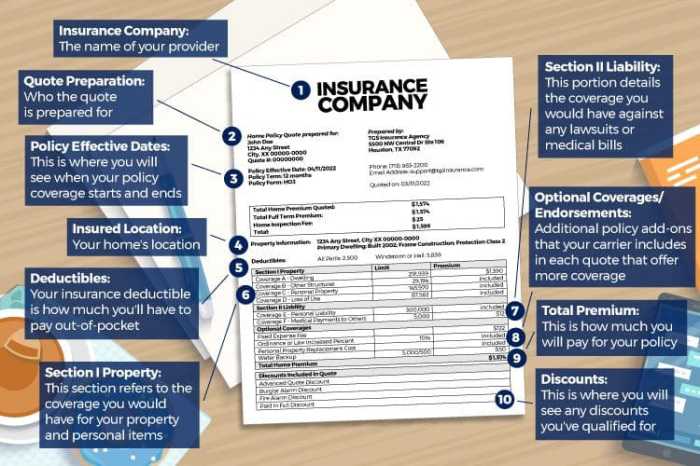

Components of a Homeowners Insurance Quote

When obtaining a homeowners insurance quote, it typically includes various components that Artikel the coverage options available to protect your home and personal belongings in case of unforeseen events. Let's delve into the different components included in a homeowners insurance quote and the types of coverage options you can expect.

Types of Coverage Options

- Dwelling Coverage: This component protects the physical structure of your home, including the walls, roof, and foundation, in case of damage from covered perils like fire, windstorms, or vandalism.

- Personal Property Coverage: It covers your personal belongings, such as furniture, clothing, and electronics, in case they are damaged, stolen, or destroyed.

- Liability Coverage: This provides protection in case someone is injured on your property and you are found liable for their injuries or damages.

- Additional Living Expenses: If your home becomes uninhabitable due to a covered event, this coverage helps pay for temporary living arrangements, such as hotel stays or rentals.

Optional Add-Ons or Endorsements

- Scheduled Personal Property: This allows you to add extra coverage for high-value items like jewelry, art, or collectibles that may exceed the limits of your standard policy.

- Flood Insurance: While not typically included in a standard homeowners insurance policy, you can add flood insurance to protect your home and belongings from flood damage.

- Sewer Backup Coverage: This endorsement covers damages caused by sewer backups, which are not usually covered by a standard policy.

- Earthquake Insurance: If you live in an area prone to earthquakes, you can add this coverage to protect your home from earthquake damage.

Obtaining a Homeowners Insurance Quote

When it comes to obtaining a homeowners insurance quote, there are a few key steps that homeowners need to follow. First and foremost, homeowners will need to reach out to insurance companies to request a quote. This can typically be done online, over the phone, or in person with an insurance agent.

Information Required for a Homeowners Insurance Quote

In order to receive an accurate homeowners insurance quote, homeowners will need to provide certain information to the insurance company. This may include details such as the address of the property to be insured, the square footage of the home, the age of the home, the materials used in construction, any additional structures on the property, and details about the homeowners themselves, such as their age, occupation, and claims history.

- Address of the property

- Square footage and age of the home

- Materials used in construction

- Information about additional structures on the property

- Details about the homeowners, including age, occupation, and claims history

Comparing Methods of Obtaining Quotes

There are various methods homeowners can use to obtain quotes from different insurance companies. Some homeowners may prefer to contact insurance companies directly by phone or in person to discuss their needs and receive personalized quotes. Others may choose to use online comparison tools that allow them to receive multiple quotes from different companies simultaneously.

Additionally, some homeowners may opt to work with an independent insurance agent who can help them compare quotes from multiple companies and provide guidance on selecting the best coverage for their needs.

Factors Influencing Homeowners Insurance Quotes

When it comes to calculating homeowners insurance quotes, insurance companies take several factors into consideration to determine the cost of coverage. Understanding these factors can help homeowners make informed decisions to potentially lower their insurance quotes.

Location

The location of your home plays a significant role in determining your homeowners insurance quote. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods may have higher insurance premiums due to increased risk.

Home Value

The value of your home is another crucial factor that influences your insurance quote. More expensive homes typically require higher coverage limits, resulting in higher premiums. It's essential to accurately assess the value of your home to ensure you have adequate coverage without overpaying.

Deductible Amount

The deductible amount you choose can impact your homeowners insurance quote. A higher deductible usually leads to lower premiums, but it also means you'll have to pay more out of pocket in the event of a claim. Homeowners should carefully consider their financial situation and risk tolerance when selecting a deductible amount.

Other Variables

Insurance companies may consider other variables such as the age of your home, the materials used in construction, the presence of safety features like smoke alarms and security systems, and your claims history when calculating your insurance quote

Understanding Homeowners Insurance Quote Comparison

When it comes to protecting your home, comparing homeowners insurance quotes from different providers is crucial. This process allows you to find the best coverage at the most competitive rates, ensuring that your home is adequately protected without breaking the bank.

Key Elements to Look for When Comparing Quotes:

- Coverage Limits: Pay attention to the coverage limits offered by each insurance provider. Make sure that the policy provides enough coverage to rebuild your home and replace your belongings in case of a disaster.

- Deductibles: Compare the deductibles across different quotes. A higher deductible usually means lower premiums, but you'll have to pay more out of pocket in the event of a claim.

- Premiums: Consider the premiums quoted by each provider. While you want to find an affordable policy, remember that the cheapest option may not always offer the best coverage.

How Homeowners Can Evaluate Coverage Limits, Deductibles, and Premiums in Quote Comparisons:

- Assess Your Needs: Determine the coverage limits you need based on the value of your home and belongings. Consider factors like location, construction materials, and personal property to ensure adequate coverage.

- Compare Deductibles: Evaluate how much you can afford to pay out of pocket in the event of a claim. Balance higher deductibles with lower premiums to find the right balance for your budget.

- Review Premiums: Look beyond the initial premium cost and consider long-term affordability. Factor in any discounts, payment options, and potential rate increases to make an informed decision.

Tips for Choosing the Right Homeowners Insurance Quote

When it comes to selecting the right homeowners insurance quote, there are several important factors to consider. It's crucial to evaluate not only the cost but also the coverage and service reputation of the insurance provider. Finding the right balance among these elements will ensure that you get the best value for your money and adequate protection for your home.

Balancing Coverage, Cost, and Service Reputation

Finding the right homeowners insurance quote involves more than just choosing the cheapest option. It's essential to assess the level of coverage offered, the cost of the policy, and the reputation of the insurance company in terms of customer service and claims handling.

Here are some tips to help you make an informed decision:

- Consider the coverage limits and exclusions: Review the details of the policy to ensure that it provides adequate coverage for your home and belongings. Pay attention to any exclusions that may leave you vulnerable in certain situations.

- Compare premiums and deductibles: While a lower premium may seem attractive, it's important to consider the deductible amount as well. A higher deductible could mean lower premiums but may require you to pay more out of pocket in the event of a claim.

- Check the reputation of the insurance company: Look for reviews and ratings of the insurance provider to gauge their customer service quality and claims handling process. A company with a strong reputation is more likely to provide reliable support when you need it most.

Scenarios Where a Higher Quote May Be Beneficial

In some cases, opting for a higher homeowners insurance quote can offer long-term benefits and peace of mind. For example:

- Comprehensive coverage: A higher quote may include additional coverage options such as guaranteed replacement cost coverage, which can be invaluable in the event of a major disaster like a fire or natural catastrophe.

- Enhanced customer service: Choosing a higher-priced policy from a reputable insurer can mean better customer service, faster claims processing, and overall smoother experience in case of emergencies.

- Specialized coverage needs: If you have unique features in your home that require specialized coverage, such as expensive jewelry or art collections, a higher quote with tailored coverage options may be the best choice to ensure full protection.

Last Word

In conclusion, this discussion sheds light on the nuances of homeowners insurance quotes, emphasizing the importance of thorough comparison and informed decision-making. Whether it's deciphering the components or navigating the factors that shape quotes, this guide strives to empower homeowners in securing the most suitable coverage for their needs.

Clarifying Questions

What information is needed to obtain a homeowners insurance quote?

Homeowners typically need to provide details such as the property's location, value, construction type, and desired coverage limits.

Do insurance companies consider credit score when calculating homeowners insurance quotes?

Yes, credit score can be a factor in determining insurance premiums for homeowners.

What are some optional add-ons in a homeowners insurance quote?

Optional add-ons may include coverage for valuable items, identity theft protection, and increased liability limits.

How can homeowners potentially lower their insurance quotes?

Homeowners can consider raising their deductibles, bundling policies, improving home security, and maintaining a good credit score to lower insurance costs.