Navigating the world of full coverage auto insurance can be complex, but understanding the ins and outs is crucial for protecting your vehicle and finances. From the types of coverage included to factors influencing costs, this guide will break down everything you need to know about full coverage auto insurance.

What is Full Coverage Auto Insurance?

Full coverage auto insurance is a type of insurance policy that provides a higher level of protection for your vehicle compared to basic liability coverage. It combines several different types of coverage to ensure you are financially protected in various situations.

Types of Coverage Included in Full Coverage Auto Insurance

- Comprehensive Coverage: This coverage protects your vehicle from non-collision related damages such as theft, vandalism, or natural disasters.

- Collision Coverage: Collision coverage helps pay for repairs to your vehicle in case of an accident, regardless of fault.

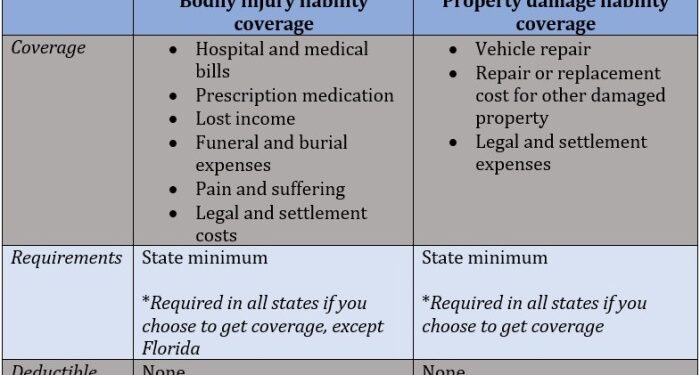

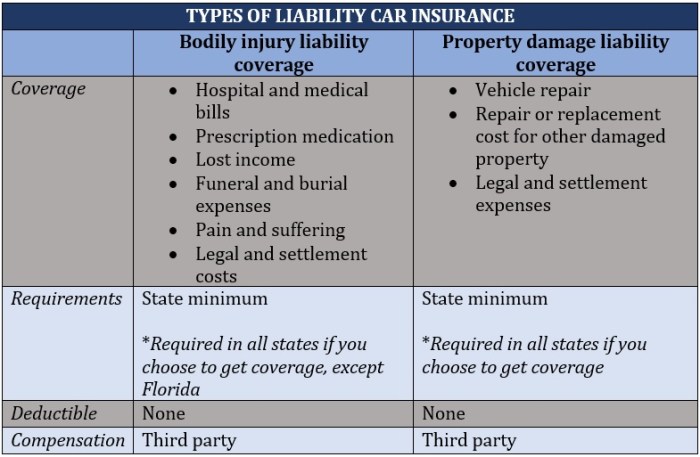

- Liability Coverage: This coverage helps cover costs if you are responsible for injuring someone else or damaging their property in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are in an accident with a driver who doesn't have insurance or enough insurance to cover the damages.

- Medical Payments Coverage: Medical payments coverage helps pay for medical expenses for you and your passengers in case of an accident.

Importance of Having Full Coverage Auto Insurance

Having full coverage auto insurance is important because it offers comprehensive protection for you, your vehicle, and others on the road. It can help cover costs associated with accidents, theft, vandalism, and other unforeseen events that could result in financial loss.

Factors to Consider When Choosing Full Coverage Auto Insurance

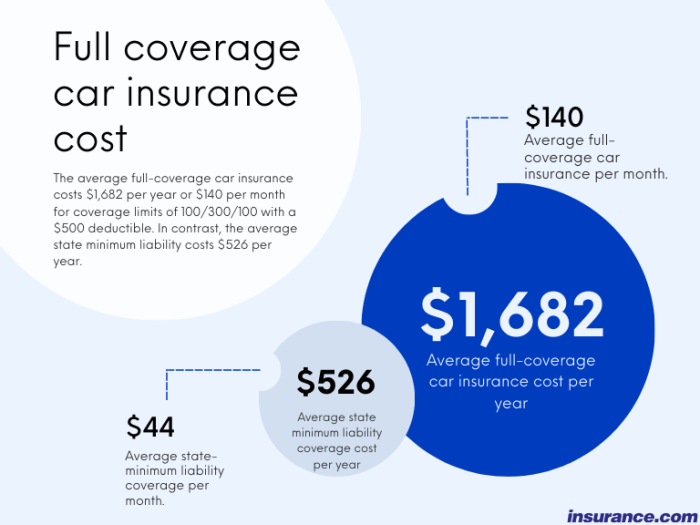

When selecting full coverage auto insurance, there are several factors to take into consideration that can influence the cost and coverage options available to you. It's essential to compare different insurance providers and understand how personal factors like age, driving history, and vehicle type can impact your insurance premiums.

Let's delve into these factors in more detail below.

Factors Influencing the Cost of Full Coverage Auto Insurance

- Age: Younger drivers typically pay higher premiums due to their lack of driving experience and perceived higher risk.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance rates, while a history of accidents or tickets may result in higher premiums.

- Vehicle Type: The make and model of your car, as well as its age and safety features, can affect insurance costs. Luxury vehicles or sports cars may have higher premiums than standard sedans or minivans.

- Location: Where you live can impact your insurance rates, with urban areas or regions with high crime rates often resulting in higher premiums.

Comparing Different Insurance Providers Offering Full Coverage

- Policy Coverage: Evaluate the extent of coverage offered by different providers, including liability, collision, comprehensive, and additional options like roadside assistance.

- Premiums and Deductibles: Compare the cost of premiums and deductibles across various insurance companies to find the most competitive rates that fit your budget.

- Customer Service: Research reviews and ratings of insurance providers to assess their customer service quality and claims handling process.

Personal Factors Affecting Full Coverage Insurance Premiums

- Driving Habits: Your daily mileage, frequency of driving, and purpose of use (personal or business) can influence insurance costs.

- Credit Score: Some insurance companies may consider your credit history when determining premiums, as a higher credit score is often associated with lower risk.

- Marital Status: Married individuals may be eligible for discounts on their insurance premiums compared to single policyholders.

Understanding Comprehensive and Collision Coverage

Comprehensive and collision coverage are two essential components of full coverage auto insurance that provide protection in different scenarios.

Comprehensive Coverage

Comprehensive coverage helps pay for damage to your vehicle that is not caused by a collision. This includes incidents such as theft, vandalism, fire, natural disasters, or hitting an animal.

- Example 1: If your car is stolen and never recovered, comprehensive coverage would help cover the cost of replacing your vehicle.

- Example 2: If a tree falls on your car during a storm, comprehensive coverage would assist in repairing the damages.

Collision Coverage

Collision coverage, on the other hand, helps pay for damages to your vehicle when you collide with another vehicle or object, regardless of fault. This coverage is particularly useful in accidents where you are at fault.

- In the event of an accident where you rear-end another car, collision coverage would help cover the cost of repairing your vehicle.

- If you hit a pole or barrier while parking, collision coverage would assist in paying for the damages to your vehicle.

Optional Coverages to Enhance Full Coverage Auto Insurance

When considering full coverage auto insurance, there are optional coverages that can be added to enhance your policy and provide additional protection. These optional coverages can offer peace of mind in various situations and help you deal with unexpected events.

Roadside Assistance Coverage

Roadside assistance coverage is an optional add-on that can be extremely beneficial in case your car breaks down or you encounter any roadside emergencies. This coverage typically includes services like towing, fuel delivery, battery jump-start, and flat tire assistance.

Rental Car Reimbursement Coverage

Rental car reimbursement coverage is another optional add-on that can be valuable if your car is in the shop for repairs after an accident. This coverage helps pay for a rental car while your vehicle is being repaired, ensuring that you have a means of transportation during this time.

Gap Insurance Coverage

Gap insurance coverage is designed to cover the difference between what you owe on your car loan or lease and the actual cash value of your vehicle in case it is totaled in an accident. This coverage can be essential to avoid financial strain if your car is declared a total loss.

Medical Payments Coverage

Medical payments coverage is an optional add-on that can help cover medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. This coverage can provide additional financial protection for injuries sustained in a car accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an optional add-on that protects you in case you are involved in an accident with a driver who does not have insurance or has insufficient coverage to pay for damages. This coverage ensures that you are not left financially responsible for someone else's negligence.

Summary

In conclusion, investing in full coverage auto insurance is a smart decision to safeguard yourself against unexpected events on the road. By selecting the right coverage and optional add-ons, you can drive with confidence knowing you're fully protected.

Question Bank

What does full coverage auto insurance entail?

Full coverage auto insurance typically includes liability, collision, and comprehensive coverage to protect you in various scenarios.

How do personal factors affect full coverage insurance premiums?

Personal factors like age, driving history, and the type of vehicle you drive can influence the cost of your full coverage auto insurance premiums.

What optional coverages can I add to enhance my full coverage auto insurance policy?

You can consider adding options like roadside assistance and rental car reimbursement to enhance your coverage and provide extra peace of mind.