Navigating the world of health insurance can be daunting, especially when it comes to emergency situations. Emergency health insurance plays a crucial role in providing financial protection during unforeseen medical crises. From coverage details to cost considerations, this guide delves into the essentials of emergency health insurance to help you make informed decisions for you and your loved ones.

Definition of Emergency Health Insurance

Emergency health insurance is a type of insurance coverage that specifically caters to unexpected medical situations that require immediate attention. It is designed to provide financial assistance for emergency medical services, hospitalization, surgeries, and other urgent healthcare needs.

Importance of Emergency Health Insurance

Emergency health insurance plays a crucial role in situations such as accidents, sudden illnesses, or unexpected medical emergencies where the cost of treatment can be exorbitant. Without this coverage, individuals may face significant financial burden or even risk their health by delaying necessary medical care.

- Quick Access to Medical Care: Emergency health insurance ensures timely access to medical services without worrying about the cost.

- Financial Protection: It helps protect individuals from high medical expenses that can arise from emergency situations.

- Peace of Mind: Knowing that emergency healthcare needs are covered can provide peace of mind and reduce stress during challenging times.

- Global Coverage: Some emergency health insurance plans offer coverage both domestically and internationally, making it ideal for travelers.

Coverage and Benefits

Emergency health insurance provides coverage for various types of medical expenses that may arise unexpectedly. This type of insurance is specifically designed to offer financial protection during medical emergencies, ensuring that individuals can access necessary healthcare without worrying about exorbitant costs.

Types of Medical Expenses Covered

- Emergency room visits

- Hospitalization

- Surgery

- Diagnostic tests

- Ambulance services

- Prescription medications

Comparison with Regular Health Insurance

- Emergency health insurance typically has lower premiums compared to regular health insurance, making it more affordable for individuals who primarily seek coverage for unexpected medical events.

- Regular health insurance offers comprehensive coverage for preventive care, routine doctor visits, and pre-existing conditions, while emergency health insurance focuses on immediate medical needs during emergencies.

- Emergency health insurance provides a safety net for sudden medical crises, offering peace of mind and financial support when individuals face unforeseen health challenges.

Role in Unexpected Medical Emergencies

Emergency health insurance plays a crucial role in helping individuals cope with unexpected medical emergencies by covering the costs associated with urgent healthcare services. In situations where immediate medical attention is required, having emergency health insurance can make a significant difference in ensuring timely access to necessary treatment without the burden of high medical bills.

Cost and Affordability

When it comes to emergency health insurance, one of the key considerations is the cost associated with obtaining coverage. Understanding the factors that influence the cost of emergency health insurance can help individuals find affordable plans that meet their needs without breaking the bank.

Factors Affecting Cost

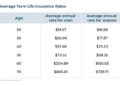

- Premiums: The monthly or annual premium is the amount you pay to maintain your emergency health insurance coverage. Premiums can vary based on factors such as age, location, and the level of coverage you choose.

- Deductibles: This is the amount you must pay out of pocket before your insurance coverage kicks in. Plans with higher deductibles typically have lower premiums, while plans with lower deductibles may have higher premiums.

- Co-payments and Co-insurance: These are additional costs that you may be required to pay when receiving emergency medical services. Understanding these costs can help you budget effectively for potential medical emergencies.

Tips for Finding Affordable Plans

- Compare Multiple Quotes: Don't settle for the first emergency health insurance plan you come across. Take the time to compare quotes from different providers to find the best value for your budget.

- Consider Catastrophic Coverage: Catastrophic plans have lower premiums but higher deductibles, making them a cost-effective option for individuals who are generally healthy and only need coverage for severe emergencies.

- Look for Subsidies: Depending on your income level, you may qualify for subsidies that can help reduce the cost of your emergency health insurance. Check with your state's health insurance marketplace for more information.

Comparison with Out-of-Pocket Expenses

In the event of a medical emergency, the cost of treatment can quickly add up. Without emergency health insurance, individuals may find themselves facing steep medical bills that can be financially devastating. By comparing the cost of emergency health insurance with potential out-of-pocket expenses, individuals can make an informed decision about the level of coverage they need to protect themselves and their finances in case of an emergency.

Eligibility and Enrollment

To be eligible for emergency health insurance, individuals typically need to meet certain criteria such as being a legal resident of the country, not being eligible for other health insurance plans, and having a qualifying life event like loss of other coverage or a change in family status.

Enrollment Process

- Research and Compare Plans: Start by researching different emergency health insurance plans and comparing their coverage, benefits, and costs.

- Check Eligibility: Ensure you meet the eligibility criteria for the selected plan before proceeding with enrollment.

- Enroll Online or by Phone: Most insurance companies allow for online enrollment through their websites or by contacting their customer service hotline.

- Provide Necessary Information: During the enrollment process, you will need to provide personal information, proof of eligibility, and payment details.

- Review and Confirm: After submitting your enrollment application, review the details to ensure accuracy and confirm your enrollment.

Limitations and Restrictions

- Open Enrollment Period: Emergency health insurance plans may have specific enrollment periods, so it is important to enroll during these designated times.

- Limited Coverage: Some emergency health insurance plans may have restrictions on pre-existing conditions or certain medical services, so be sure to understand the limitations before enrolling.

- Age Restrictions: Certain plans may have age restrictions for enrollment, particularly for children or seniors, so check the age eligibility requirements carefully.

Claim Process and Coverage Limits

When it comes to emergency health insurance, understanding the claim process and coverage limits is crucial for ensuring you receive the necessary care without facing financial burdens.

Filing a Claim

- Notify your insurance provider immediately in the event of an emergency.

- Fill out the necessary claim forms with accurate details and documentation.

- Submit the completed forms along with any supporting documents to the insurance company.

- Wait for the claim to be processed and approved, after which reimbursement or direct payment may be provided.

Coverage Limits and Exclusions

- Emergency health insurance plans often have specific coverage limits for various services, treatments, and procedures.

- Exclusions may include pre-existing conditions, elective procedures, and non-emergency treatments.

- Coverage limits may vary based on the type of emergency, duration of treatment, and medical facilities utilized.

Scenarios of Coverage Limits

- If the emergency treatment exceeds the coverage limit, you may be responsible for the remaining costs.

- Certain procedures or medications may not be covered if they are deemed non-essential or experimental.

- In cases where the emergency is not considered life-threatening, coverage limits may impact the extent of care provided.

Outcome Summary

As we conclude our exploration of emergency health insurance, it's evident that being prepared for unexpected medical emergencies is a wise investment. By understanding the coverage, benefits, and costs associated with emergency health insurance, you can secure peace of mind knowing that you have a safety net in place for times of need.

Stay informed, stay protected, and prioritize your health and well-being above all else.

Detailed FAQs

What does emergency health insurance cover?

Emergency health insurance typically covers sudden and unforeseen medical expenses such as hospitalization, surgeries, ambulance services, and emergency room visits.

Can I enroll in emergency health insurance at any time?

Most emergency health insurance plans have specific enrollment periods, but some may allow for special enrollment under certain circumstances such as life-changing events.

How does emergency health insurance differ from regular health insurance?

Emergency health insurance is designed to provide coverage for unexpected medical emergencies only, whereas regular health insurance offers comprehensive coverage for routine medical expenses as well.

Are pre-existing conditions covered by emergency health insurance?

Emergency health insurance typically does not cover pre-existing conditions, so it's important to check the policy details for specific exclusions.

What are the key features to look for in an emergency health insurance plan?

When choosing an emergency health insurance plan, consider factors such as coverage limits, network of healthcare providers, claim process efficiency, and any additional benefits offered.