Cheap homeowners insurance is not just about saving money; it's about protecting your most valuable asset. Understanding the key factors that influence the cost of insurance and debunking common misconceptions are crucial steps in finding the right coverage. Let's delve into the world of cheap homeowners insurance and explore the ins and outs of this essential financial safeguard.

Understanding Cheap Homeowners Insurance

Cheap homeowners insurance refers to a type of insurance policy that offers affordable coverage for your home and personal belongings. The cost of cheap homeowners insurance is influenced by various factors such as the location of your home, the age and condition of the property, the coverage limits, and your deductible amount.

Having homeowners insurance is crucial as it provides financial protection in the event of unexpected incidents like natural disasters, theft, or accidents that cause damage to your property. Without insurance, you could be left with a significant financial burden to repair or replace your home and belongings.

Typical Coverage Options in Cheap Homeowners Insurance Policies

- Dwelling coverage: This protects the physical structure of your home from covered perils such as fire, windstorm, or vandalism.

- Personal property coverage: This helps cover the cost of replacing your personal belongings like furniture, clothing, and electronics if they are damaged or stolen.

- Liability coverage: This provides protection if someone is injured on your property and decides to sue you for damages.

- Additional living expenses coverage: This helps cover the cost of temporary living arrangements if your home becomes uninhabitable due to a covered loss.

Factors Affecting Homeowners Insurance Costs

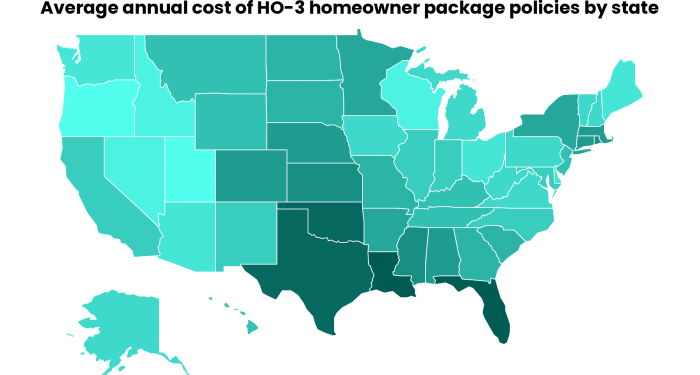

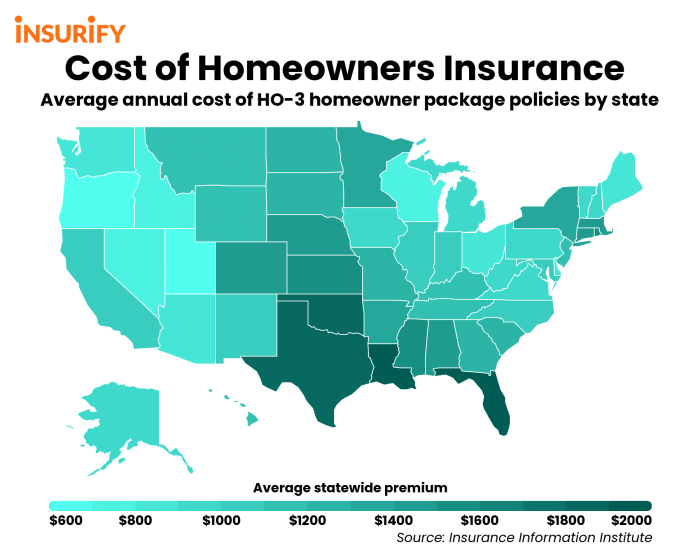

When it comes to homeowners insurance, several factors can influence the cost of coverage. Understanding these factors is essential for homeowners looking to manage their insurance expenses effectively.Location plays a significant role in determining homeowners insurance costs. Areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, typically have higher insurance premiums.

Additionally, the proximity to a fire station or the crime rate in the neighborhood can also impact the cost of coverage.The value of your home is another crucial factor that affects insurance costs. More expensive homes generally require higher coverage limits, resulting in higher premiums.

On the other hand, older homes may have higher insurance costs due to potential maintenance issues or outdated systems.The deductible amount is the out-of-pocket expense that homeowners must pay before their insurance coverage kicks in. Choosing a higher deductible can help lower insurance premiums, but it also means you'll have to pay more in case of a claim.

Homeowners should carefully consider their financial situation before deciding on a deductible amount.Coverage limits refer to the maximum amount your insurance policy will pay for a covered loss. Opting for higher coverage limits can increase your insurance costs, but it provides better protection in case of a significant loss.

Homeowners should review their coverage needs regularly to ensure they have adequate protection without overpaying.To lower their insurance costs, homeowners can take several steps. Installing safety features such as smoke alarms, security systems, or impact-resistant roofing can make your home safer and reduce insurance premiums.

Additionally, bundling your homeowners insurance with other policies, such as auto insurance, can lead to discounts from insurers.By understanding the factors that influence homeowners insurance costs and taking proactive measures to mitigate risks, homeowners can effectively manage their insurance expenses while ensuring adequate protection for their homes.

Tips for Finding Affordable Homeowners Insurance

When looking for affordable homeowners insurance, it's important to consider various strategies to save on your premiums and get the best coverage for your needs.

Comparing Quotes from Different Insurance Companies

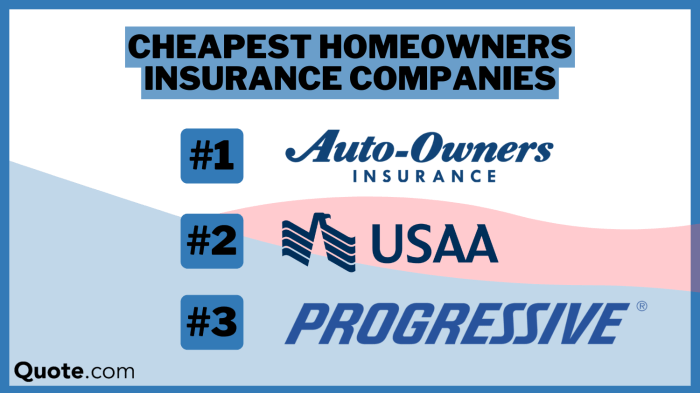

- Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Consider using online comparison tools to streamline the process and find the best deal.

- Look beyond the price and also assess the reputation and customer service of each insurance provider.

Discounts for Homeowners

- Ask about discounts for bundling your homeowners insurance with other policies like auto or life insurance.

- Check for discounts for having safety features in your home such as smoke alarms, security systems, or impact-resistant roofing.

- Inquire about loyalty discounts for long-term customers or discounts for paying your premium in full upfront.

Review and Adjust Coverage Levels Periodically

- Regularly review your coverage levels to ensure you are not over-insured or under-insured.

- Consider adjusting your deductible to lower your premium, but make sure you have enough savings to cover the deductible in case of a claim.

- Update your coverage as needed based on changes to your home, belongings, or financial situation to ensure you have adequate protection.

Common Misconceptions About Cheap Homeowners Insurance

When it comes to cheap homeowners insurance, there are several misconceptions that can lead homeowners to make uninformed decisions. Let's debunk these myths and provide accurate information to help homeowners understand their insurance options better.

Coverage Quality

One common misconception about cheap homeowners insurance is that it offers subpar coverage compared to more expensive options. While cheaper policies may have lower coverage limits, it is still possible to find affordable insurance that meets your needs. It's essential to carefully review the policy details and ensure that you have adequate coverage for your home and belongings.

Claim Processes

Another misconception is that filing a claim with a cheap homeowners insurance provider will be a complicated and lengthy process. In reality, the claim process is generally similar across different insurance companies. The key is to document the damage thoroughly, provide all necessary information, and work closely with your insurance company to ensure a smooth claims process.

Affordability

Some homeowners believe that cheap homeowners insurance is not affordable in the long run because it may lead to higher out-of-pocket costs in the event of a claim. While it's true that cheaper policies may have higher deductibles, they can still provide cost-effective coverage for many homeowners.

By comparing quotes from different insurers and understanding the terms of the policy, homeowners can find affordable insurance that offers adequate protection.

Closure

In conclusion, cheap homeowners insurance offers a cost-effective way to protect your home and belongings. By following the tips provided and being aware of the factors that affect insurance costs, homeowners can make informed decisions and secure the coverage they need.

Remember, affordable insurance doesn't have to mean sacrificing quality – it's all about finding the right balance.

FAQ Corner

What factors contribute to the cost of cheap homeowners insurance?

The cost of cheap homeowners insurance is influenced by factors such as location, home value, deductible amount, and coverage limits.

How can homeowners lower their insurance costs?

Homeowners can lower their insurance costs by comparing quotes, qualifying for discounts, and reviewing coverage levels periodically.

What are common misconceptions about cheap homeowners insurance?

Common misconceptions include doubts about coverage quality, claim processes, and the affordability of cheap insurance options.