Exploring the realm of life insurance quotes, this introductory piece sets the stage for an enlightening journey into understanding the intricacies of securing the right coverage. It aims to provide valuable insights and essential information in a manner that captivates and informs readers.

In the following paragraphs, we will delve into the specifics of life insurance quotes, shedding light on their importance and how they can impact your financial planning.

What is a Life Insurance Quote?

A life insurance quote is an estimate of the premium cost for a specific life insurance policy based on various factors such as age, health status, lifestyle, and coverage amount.

How Life Insurance Quotes are Calculated

Life insurance quotes are calculated by insurance companies using actuarial tables and risk assessment algorithms. These factors help determine the likelihood of the insured individual making a claim and help set the appropriate premium amount.

- Age: Younger individuals typically pay lower premiums as they are considered to be at lower risk of health issues.

- Health Status: Individuals with pre-existing medical conditions may have higher premiums as they pose a higher risk to the insurance company.

- Lifestyle: Factors such as smoking, alcohol consumption, and participation in high-risk activities can impact the premium amount.

- Coverage Amount: The higher the coverage amount, the higher the premium is likely to be.

Importance of Obtaining a Life Insurance Quote

Obtaining a life insurance quote is crucial for individuals looking to protect their loved ones financially in the event of their passing. It helps individuals assess the cost of coverage and choose a policy that aligns with their needs and budget.

Types of Life Insurance Policies

Life insurance policies come in various types to cater to different needs and preferences. Two common types are term life insurance and whole life insurance.Term Life Insurance:Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years.

If the policyholder passes away during the term, their beneficiaries receive the death benefit. This type of policy is generally more affordable than whole life insurance and is suitable for those looking for temporary coverage.Whole Life Insurance:Whole life insurance, on the other hand, provides coverage for the entire lifetime of the policyholder.

In addition to the death benefit, whole life insurance also includes a cash value component that grows over time. This type of policy offers lifelong protection and can serve as an investment vehicle.Features and Benefits:

Term Life Insurance

Lower premiums compared to whole life insurance.

Simple and straightforward coverage for a specific term.

Ideal for those seeking affordable coverage for a certain period.

Whole Life Insurance

Lifetime coverage with a guaranteed death benefit.

Cash value accumulation that can be borrowed against or withdrawn.

Acts as a long-term investment with potential for growth.

When choosing between term life insurance and whole life insurance, it is essential to consider your financial goals, budget, and coverage needs. Each type of policy offers distinct advantages, so it's crucial to assess your priorities and consult with a financial advisor to determine the most suitable option for you.

Factors Affecting Life Insurance Quotes

When it comes to getting a life insurance quote, there are several key factors that can influence the final premium you'll have to pay. Factors such as age, health, and lifestyle choices play a significant role in determining the cost of your life insurance policy.

Age and Health

Age and health are two critical factors that can greatly impact your life insurance premiums. Generally, the younger and healthier you are, the lower your premiums will be. This is because younger individuals are considered to be at a lower risk of developing health issues or passing away prematurely.

On the other hand, as you age, the risk of developing health conditions increases, leading to higher premiums. Additionally, pre-existing health conditions can also result in higher premiums due to the increased risk they pose to the insurance company

Lifestyle Choices

Your lifestyle choices can also affect your life insurance quotes. Factors such as smoking, excessive drinking, or engaging in high-risk activities like skydiving or rock climbing can lead to higher premiums. These activities are considered risky by insurance companies as they increase the likelihood of premature death or health complications.

On the other hand, maintaining a healthy lifestyle by exercising regularly and eating a balanced diet can help lower your premiums as it reduces the risk of developing health issues.

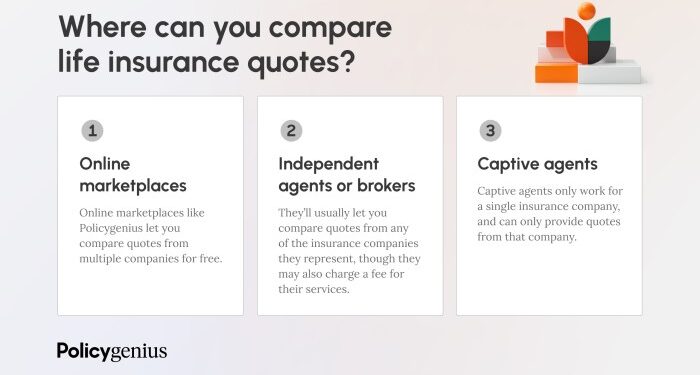

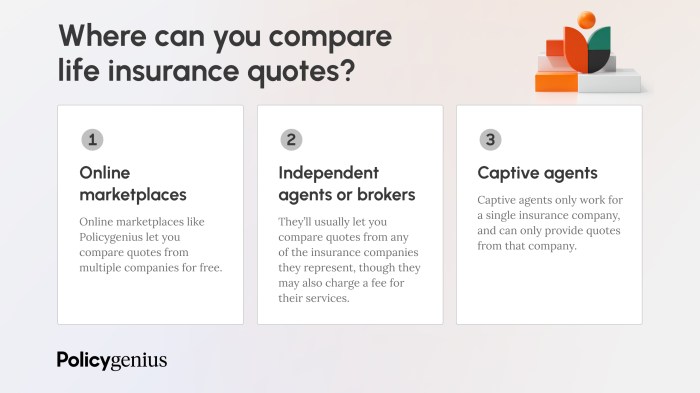

How to Get a Life Insurance Quote

Obtaining a life insurance quote is a crucial step in securing financial protection for your loved ones. Here's how you can go about getting a life insurance quote and ensuring you make an informed decision.

Process of Obtaining a Life Insurance Quote

- Contact Insurance Companies: Reach out to different insurance companies to request a quote. You can do this online, over the phone, or in person.

- Provide Information: Be prepared to share relevant personal details such as age, health history, lifestyle habits, and desired coverage amount.

- Review Options: Once you receive quotes from various insurers, carefully review the coverage, terms, premiums, and any additional benefits offered.

- Choose Wisely: Compare the quotes based on your needs, budget, and the reputation of the insurance company before making a decision.

Tips on Comparing Quotes from Different Insurers

- Compare Coverage: Look beyond the premium amount and consider the coverage offered by each insurer. Ensure it meets your financial goals and provides adequate protection.

- Consider Reputation: Research the reputation and financial stability of the insurance companies to ensure they can fulfill their promises in the future.

- Check Exclusions: Pay attention to any exclusions or limitations mentioned in the policy to avoid surprises during claims.

- Seek Professional Advice: If you're unsure about certain terms or options, consider consulting with a financial advisor or insurance agent.

Importance of Reviewing Details of a Life Insurance Quote

- Understand Policy Terms: Carefully review the terms and conditions of the policy to avoid misunderstandings in the future.

- Ensure Adequate Coverage: Make sure the coverage amount and type align with your financial goals and provide sufficient protection for your loved ones.

- Check Premiums and Riders: Evaluate the premium amount and any additional riders offered to see if they fit within your budget and address specific needs.

- Stay Informed: Stay informed about any changes in the policy, such as renewal terms or benefits, to make informed decisions throughout the policy term.

Importance of Life Insurance

Life insurance plays a crucial role in providing financial protection and security for your loved ones in the event of your passing. It offers peace of mind knowing that your family will be taken care of even when you are no longer around.

Financial Security for Loved Ones

Life insurance ensures that your family members are financially supported after your demise. It can help cover daily living expenses, mortgage payments, and children's education, easing the financial burden during a difficult time.

Covering Funeral Expenses and Debts

Upon your death, life insurance can help cover funeral expenses, which can otherwise be a significant financial strain on your family. Additionally, it can be used to pay off any outstanding debts, ensuring that your loved ones are not left with financial liabilities.

Ultimate Conclusion

In conclusion, the essence of obtaining a life insurance quote cannot be overstated. It serves as a crucial step towards safeguarding your loved ones' future and ensuring financial stability in times of need. With the right knowledge and guidance, navigating the world of life insurance quotes can lead to peace of mind and security.

FAQ

What factors can influence the cost of a life insurance quote?

Factors such as age, health condition, occupation, and lifestyle choices can impact the premium you pay for life insurance.

How can I ensure I'm getting the best life insurance quote?

To get the best quote, compare offers from different insurers, consider your coverage needs, and review policy details carefully.

Is it necessary to disclose all medical history when getting a life insurance quote?

Yes, providing accurate medical information is crucial for an insurer to offer you a fair and appropriate life insurance quote.